Founded 40 years ago on the simple idea of creating innovative products that change the world, Adobe offers groundbreaking technology that empowers everyone, everywhere to imagine, create, and bring any digital experience to life.

Changing the world through personalized digital experiences.

Remembering our co-founder Dr. John Warnock.

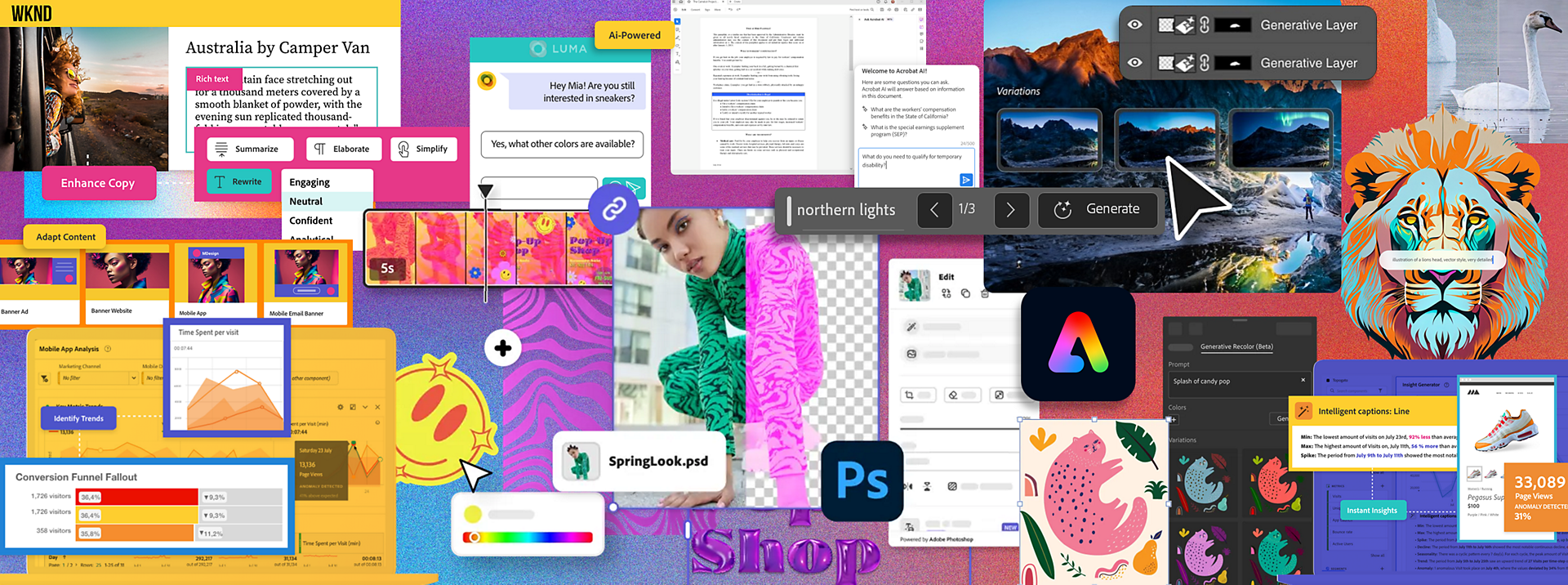

Adobe and AI.

Adobe is making the world more creative, productive, and personalized with artificial intelligence as a co-pilot that amplifies human ingenuity.

Adobe Sensei

Adobe has delivered hundreds of intelligent capabilities in its applications through Adobe Sensei technology, enabling customers to create, work, and collaborate more efficiently.

Adobe Firefly

Our family of new creative generative AI models is bringing even more precision, power, speed, and ease directly into Adobe workflows. Now everyone can generate high-quality images that are designed to be safe for commercial use.

Adobe Sensei GenAI

Adobe Sensei GenAI brings generative AI capabilities into Adobe Experience Cloud to power more productive marketing and customer experience workflows.

Explore our products.

From students to creative professionals, and from small businesses to the world’s largest enterprises, our customers are using Adobe products to unleash their creativity, accelerate document productivity, and power digital businesses.

Adobe Creative Cloud

Adobe Creative Cloud gives anyone, anywhere the most powerful tools to express their creativity.

Adobe Document Cloud

Adobe Document Cloud modernizes how people view, share, and engage with documents.

Adobe Experience Cloud

Adobe Experience Cloud gives digital businesses everything they need to design and deliver great customer experiences.

Adobe Express

Adobe Express, our template-based web and mobile app, empowers everyone to create standout content.

Customer stories.

See how our customers are designing, developing, and delivering amazing experiences with Adobe products.

Purpose is at our core.

See how we’re working to create positive change in the world.

Adobe for all

We’re committed to creating a workplace that reflects the diversity of the world around us.

Creativity for all

As the creativity company, we’re uniquely committed to empowering the world’s creators.

Technology to transform

We’re committed to advancing the responsible use of technology for the good of society.

Our values

Our company values — Create the future, Own the outcome, Raise the bar, and Be genuine — represent who we are, how we show up in the world, and how we’ll define our future success.