Acrobat Sign

Digital mortgages and the future of lending are powered by e-signature.

Explore the ins and outs of the mortgage process and how online notarization and other touchpoints are entering the digital landscape.

What every lender should know about digital mortgages.

- Digital mortgages are almost identical to traditional mortgages, but a digital mortgage uses technology to touch base with borrowers at every stage of the lending process no matter where they are.

- This type of mortgage reduces costs, eliminates the manual process, and streamlines the entire operation.

- When refinancing, purchasing, or selling, e-signatures and cloud technology can assist, especially when paired with new online notary signing services.

Mortgage lenders continue to be an important part of the process.

Many traditional mortgage lenders wonder if they’re becoming obsolete as new digital technologies come to the fore. It’s a question asked about many professions in the digital age, but the answer is a resounding no. The digital mortgage process isn’t designed to eliminate or remove a broker or brokerage team from the process, but rather to make sure that things run more efficiently with a much lower margin of error.

However, many traditional mortgage lenders are finding themselves in competition with digital mortgage services. Online mortgage companies may offer more competitive rates, faster approval times, and easy applications. But online mortgage operations can lack a human touch, which means traditional brokers can stay competitive by bringing their years of expertise to the digital mortgage process and opening up new opportunities for themselves.

Do online mortgage lenders have better rates?

While many online lenders offer competitive rates, adopting e-signature and other digital documentation methods can help save lenders and buyers money, further closing any rate gap. You can speed up signing and make it more convenient while limiting travel, offering a personal touch paired with the efficiency benefits of e-signatures.

Why should lenders adapt to digital mortgages and technology?

The COVID-19 pandemic resulted in a massive shift toward digital communication and remote work. This shift will likely remain the norm for a long time. Customers have come to expect more rapid communication and ease of access to services that do not require them to be physically present.

Customers are also more educated about the mortgage and lender process, and millennial home buyers especially expect digital processes from most aspects of work and life. Digital and self-service applications are commonplace now. According to Forbes, mobile apps are a factor, with 47% of borrowers saying availability of one app would factor into their decision in 2020 (compared to 40% in 2018).

In short, digital mortgages are something that customers now expect. But how does that benefit lenders?

The benefits for lenders.

Adopting digital signature technology like Acrobat Sign, as well as many of the form features it has, can dramatically increase your brokerage’s efficiency and save money. Digital mortgage technology offers unbeatable benefits:

- Speedier closing times

- Money saved on paper and office supplies

- Easier management of documents

- Secure and compliant process

- Time saved with fewer face-to-face meetings

- Accurate and timely collaboration

- Integration with many common applications

Another benefit is that adopting digital mortgages and technologies can help reduce environmental footprints. By switching from paper-heavy processes to digital-only processes, NatWest Group in the UK saved 9 million sheets of paper, 960,000 gallons of water, and 336,000 pounds of wood.

How traditional lending is adapting to the rise of digital mortgages.

As loan officers, loan originations, and the mortgage loan industry adapt to the rise of digital mortgages, a far different mortgage experience has appeared for prospective buyers.

Digital products and automation are everywhere.

The convenience and ease of using phone apps and online applications for work, banking, and shopping shifts expectations for customers, and home buyers are no different. Lenders now offer online applications, digital loan profiles, live chat and chatbots, customer self-service portals, and more, so they can keep up with the ease of many digital mortgage application processes.

Online presence is necessary.

For brokers, LinkedIn and other social media platforms serve as efficient ways to network and reach new customers. A social presence that features credentials and overviews of products and services is almost obligatory for bringing in new customers to a mortgage company.

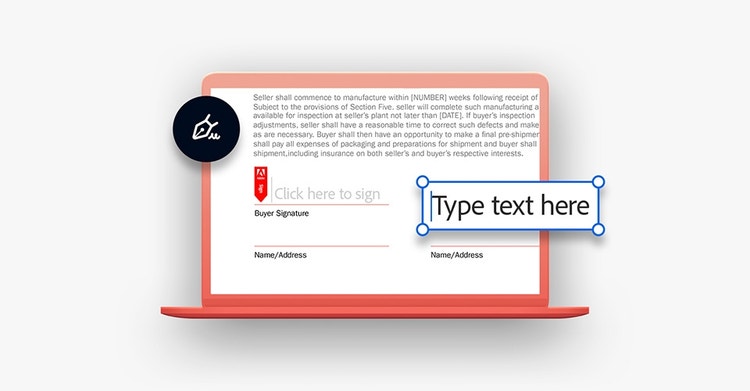

The mighty e-signature is a must.

With e-signatures, the faster turnaround time for important documents helps make customers happier and keeps documents better protected. Plus, they’re legally binding and accessible for members of your team and your customers. Within the lending and real estate process, there must be security and fraud protection, and with secure forms like the ones Acrobat Sign provides, documents can be secure and be tracked safely.

Modernize with Acrobat Sign for lenders.

Customers looking for a loan have to navigate a challenging mortgage market, with fluctuating mortgage rates, ever-changing interest rates, and complex processes.

Nail-biting wait times while paperwork passes to notaries, loan servicers, and other stakeholders can be agonizingly slow. With Acrobat Sign and e-signatures that are verifiable, secure, and compliant with regulations, the entire process is more streamlined for both online lenders and individual borrowers. Learn more about how e-signatures can supercharge your brokerage.