Adobe Acrobat Sign

Write up invoices that seal the deal.

Invoicing is essential for freelancers, small businesses, and even enterprises. Learn what to include in an invoice and discover how electronic signatures can help you get paid faster.

What is an invoice?

An invoice is a request for payment for goods and services, usually itemizing each one and offering explanations for every amount. It also includes fees, penalties, discounts, or other elements that can affect a total amount or subtotal. It usually informs a customer or recipient how and when to pay for said goods or services.

When to use an invoice.

Vendors use invoices to inform their customers about payments and also to document transaction details. Invoices can help set and manage expectations for the time and manner of payments.

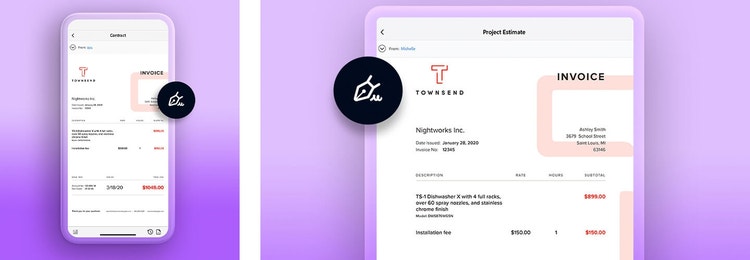

Digital invoices can help businesses and other vendors save time and money. Electronic invoicing, especially mobile invoicing, can make the entire payment process faster, smoother, and easier.

What to include in an invoice.

A professional invoice should include the following line items:

- Information about the parties, including the name of the vendor and customer, business addresses, phone numbers, and other contact information

- An invoice number, if applicable

- The date of the transaction and date of the invoice

- An itemized list of products or services, including prices and a subtotal

- Any deposits, prepayments, or other fees already paid

- Any discounts, bonuses, or waived fees included

- Sales tax, appropriate to the region in question

- Service fees or gratuities, if applicable

- Late fees or other penalties, if applicable

- The total amount due

- Brief instructions for payment methods

- The due date for payment

- Possible action in the event of late payment

- Any additional relevant information

How to write an invoice.

When you create an invoice, align it with your existing accounting and tax filing needs. Familiarize yourself with regulations or laws in your jurisdiction or that of the recipients, and create your document accordingly. Also keep in mind how clients usually pay or prefer to pay, with payment options for debit or credit card, bank transfers, or using a third-party app like PayPal, depending on the norms and preferences of your industry.

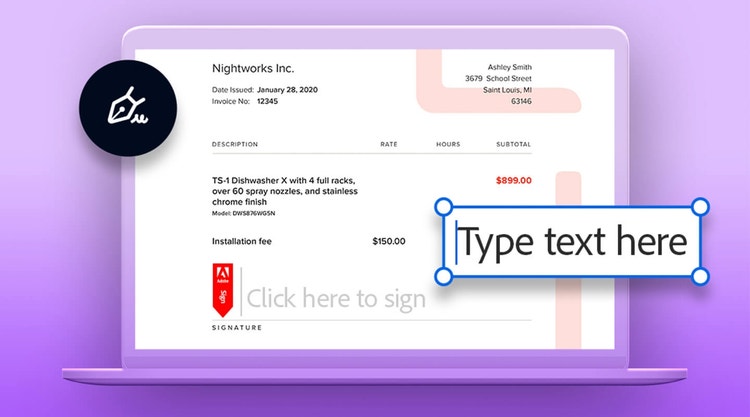

Make payments easier for everyone with electronic signatures.

Invoices sometimes require the recipient’s signature, acknowledging that they have received the document and agree to pay. Electronic signatures can help speed up that process. E-signatures are legal and binding in every state and territory of the U.S. and in many other countries around the world.

Close deals faster with e-signatures.

Electronic signatures make transactions of all kinds more efficient, including invoicing. An option to e-sign a document can make a specific interaction smoother for everyone from a small business owner to an enterprise or government.

Saving paper, serving citizens.

Governments have to deal with thousands of types of contractors and vendors on a daily basis. The State of Hawaii implemented a digital signature program, and saved over 24,000 pages of paper a day, making it better able to deliver services to its citizens.

Smoother banking with e-signatures.

London’s TSB Bank estimates that 75% of its customers use online banking, so it was only natural for them to go digital. After instituting digital signatures, it was able to replace 15,000 branch visits with online interactions and process over 140,000 forms in three months, increasing the digital self-service rate by 9%.

Make invoices easier with Adobe Acrobat Pro.

Adobe Acrobat Pro makes it easier to request payment from clients and partners. You’ll know when your recipient has viewed the invoice and when they’ve signed it. Link to online payments, integrate your invoices into your workflow, and collect binding signatures that close transactions faster.