Adobe Acrobat Sign

Learn how to quickly fill out and sign small business loan applications.

With its loan programs, the SBA offers aid to small businesses of all kinds. Discover how to submit an application using secure Adobe e-signatures.

Get your business going with more working capital.

With lower down payments, flexible overhead requirements, and competitively low interest rates, the US Small Business Administration (SBA) loan program is a good option for many small businesses. And depending on your loan amount, sometimes no personal property collateral is even needed. This reduces risk and enables easier access to capital for many small companies.

SBA loans can range from small amounts to large sums and can be used for most business purposes. This covers everything from operating expenses, like rent and salaries, to fixed assets, like equipment and real estate. If you want to receive an SBA loan or federal relief, you’ll need to complete and submit an SBA loan application — and you’ll need software like Acrobat Sign and Acrobat Pro to do it.

What is an SBA loan?

The SBA offers counseling, loan programs, and support to business owners and their companies. The SBA is a federal program, and while it doesn’t directly lend funds to small business owners, it sets the guidelines for lenders, borrowers, and loan eligibility. This makes it easier for small businesses to get the funds they need to grow and thrive.

The SBA also provides special assistance programs in times of economic hardship or in declared disaster areas. Specific COVID-19 relief options are available in the form of a COVID-19 Economic Injury Disaster Loan (COVID-19 EIDL). These SBA disaster assistance programs can preserve jobs and help a small business in need.

Save time filling out your application.

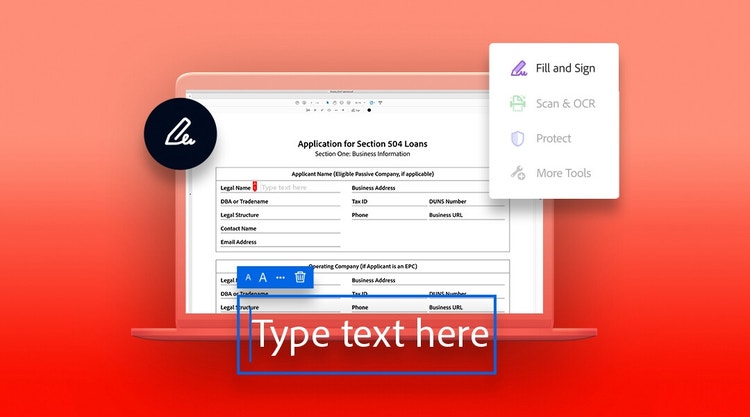

With any loan application, it’s easiest if you fill out the detailed forms digitally. With Adobe Fill & Sign, you can add and edit text within your SBA form, sign the document, and then share it with your internal team to ensure the information is up to date and approved. You can also save time by using Adobe Scan to turn physical documents into editable digital forms.

Borrowers often need to compile a variety of forms depending on the type of loan and the lender. With Adobe Document Cloud you can keep all your documents in one place while maintaining their security and accessibility to the rest of your team.

Streamline your approval process.

With Microsoft and Outlook integration, it’s simple to share documents with the rest of your team. Whether you need to confirm tax details from the IRS or simply want to discuss the loan amount with your business partners, it’s fast and easy to edit your application with Adobe Fill & Sign.

It’s also easy to get documents approved with Acrobat Sign. With just a few clicks you can add collaborators to the application, assign fields to each person, set reminders for each recipient to sign, and send it out for signature. Beyond your internal team, Acrobat Sign is easy to use for both senders and recipients. More and more, banks and financial institutions are regularly using e-signatures instead of signing paper copies. Your recipients can also sign the application using the Acrobat Sign mobile app.

Keep your information secure.

As with any application, you’ll need to provide sensitive information while applying for an SBA loan. This includes financial records, tax info, and insurance data. With Document Cloud, your application and all the accompanying info are protected. You can share access with specific users, track document activity, and password-protect your files.

Explore these Acrobat Sign success stories.

While every SBA loan application is different, Adobe PDF tools can help you quickly and accurately compile your information and submit your application.

Speed up loan contracts.

Learn how Sony Bank saved time with paperless mortgage loan contracts using Acrobat Sign, and helped their customers secure their loans and their properties more quickly.

Keep financials protected.

Explore how improved its customer experience while maintaining financial data security using Acrobat Sign and Document Cloud.

Continue improving your workflow with Acrobat Sign.

After you’ve submitted your SBA loan application, Acrobat Sign can continue to save your business time while improving day-to-day processes. From filing taxes to paying the rent, small businesses need safe and secure ways to sign contracts and complete transactions. With a mobile app and easy sharing capabilities, Acrobat Sign is the perfect tool for getting the job done.