ACROBAT

Free budget templates & how to create a household monthly budget

Budget your monthly finances easily with our guide and free budget template.

Creating and maintaining a monthly budget is a crucial aspect of personal financial management, yet it is a task often overlooked or underestimated by many individuals. The process of tracking and controlling your expenses can seem overwhelming, but it doesn’t have to be.

One effective tool that can simplify this process is a monthly budget template. Whether you are a seasoned budgeter or just starting your financial journey, learning how to create and use a budget template will equip you with the knowledge and resources to build a budget that suits your lifestyle and goals.

To help simplify your financial planning, we’ve designed this monthly budgeting guide with essential tips and free templates to get you started. We’ll cover the purpose of a budget template, three different types of monthly templates, and steps to customizing your household budget.

What is a budget template, and 3 reasons you need one.

A budget template is a pre-designed framework that helps you organize and manage your financial information in a systematic manner. It serves as a guide, providing structure and categories to track your income, expenses, savings, and investments. Think of it as a roadmap for your finances, outlining where your money is coming from and where it is going.

Here are some of the primary benefits that come with using a budget template:

- Simplified budgeting. One of the top advantages of using a budget template is that it simplifies the process of budgeting, especially for those who may find the task daunting or time-consuming. With a free budget template, you don’t have to start from scratch or spend hours creating a budgeting system. Instead, you can leverage the pre-built structure and modify it according to your specific needs.

- Organized income tracking. A template allows you to track your income sources, such as salaries, freelance work, or passive income streams, and categorize your expenses into various categories, like housing, transportation, groceries, entertainment, and more. By visualizing your income and expenses in an organized manner, you gain valuable insights into your spending patterns and can make informed decisions about where to allocate your resources.

- Prioritized financial responsibility. A budget template encourages discipline and accountability. It serves as a constant reminder to stay on track with your financial goals, whether it’s saving for a down payment on a house, paying off debt, or planning for retirement. Having a structured budgeting system helps you prioritize your spending and make adjustments as needed, ensuring that your money is working toward your desired outcomes.

3 free budget templates

There are many types of monthly budget templates available to help you streamline your financial management process for your household or business. In this section, we’ll explore three types of templates — the 50/30/20 budget template, a monthly family budget and a simple budget template.

Each template caters to different needs and preferences, providing a structured framework to track and allocate your income and expenses effectively. Whether you prefer a balanced approach to spending, managing family finances, or keeping your budgeting style simple, these templates offer a solid foundation for customizing your personal budget.

1) 50/30/20 budget template.

The 50/30/20 budget template is a popular method for allocating your income into three distinct categories — needs, wants, and savings. This template ensures a balanced approach to managing your finances.

The “50” represents 50% of your income, which is dedicated to essential needs such as housing, utilities, groceries, transportation, and other crucial expenses. The “30” denotes 30% of your income, which can be used for discretionary spending and wants like dining out, entertainment, hobbies, and non-essential purchases. Lastly, the “20” signifies 20% of your income, which should be allocated toward savings, investments, and debt repayment.

This framework template provides a clear direction for balancing your immediate needs, enjoying some discretionary spending, and building a strong financial foundation for the future.

Here is a free budget for the 50/30/20 style:

2) Monthly family budget template.

If you have a family, managing your finances can become more complex due to various household expenses and multiple sources of income. A monthly family budget template helps you keep track of all these factors while ensuring everyone’s needs are met.

This template typically includes categories specific to family expenses, such as childcare, education, healthcare, extracurricular activities, and household maintenance. It allows you to allocate funds for each family member’s needs, track shared expenses, and plan for family goals like vacations or saving for college. A monthly family budget template provides a comprehensive overview of your family’s financial health and enables effective communication and collaboration in managing your finances together.

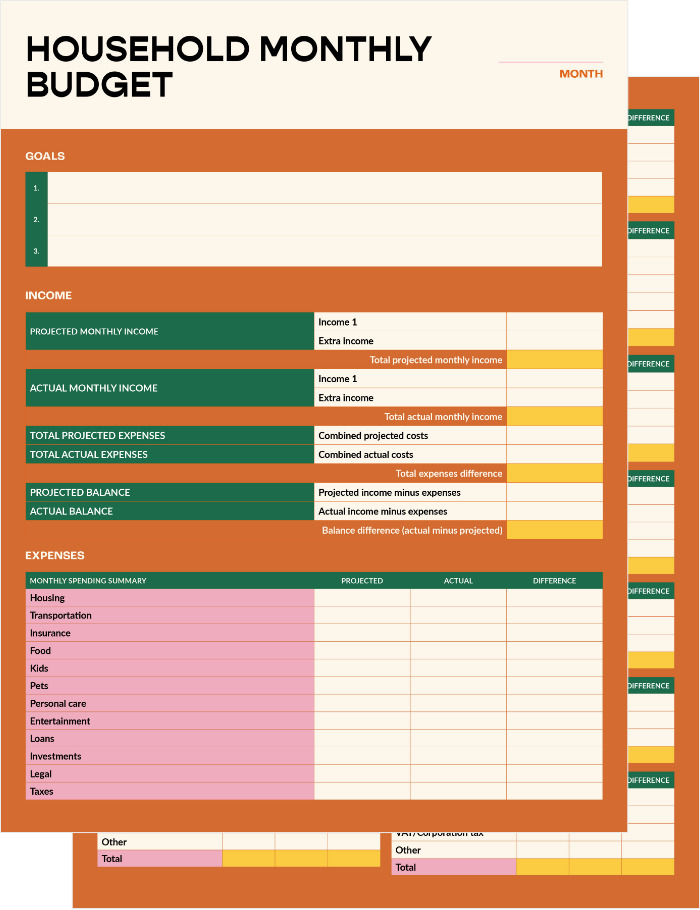

Here is a free budget template for a family household:

3) Free simple budget template

For those who prefer a minimalist approach or are just getting started with budgeting, a simple monthly budget template can be the ideal choice. This template focuses on the essential elements of budgeting, providing a straightforward framework to track your income and expenses. It typically includes basic categories such as income sources, fixed expenses (for example, rent or mortgage and utilities), variable expenses (for example, groceries or transportation), savings, and debt payments.

A simple monthly budget template allows you to establish the foundation of budgeting without getting overwhelmed with excessive details. It provides a clear snapshot of your financial inflows and outflows, making it easier to identify areas for improvement and make necessary adjustments. If you want to get more specific and break down your budget even further, try creating a weekly budget.

Here is a free budget template that's simple and easy to follow:

Customize your free budget template in 7 steps.

Customizing a budget template allows you to tailor it to your specific financial needs and preferences. By personalizing the template, you can ensure that it accurately reflects your income sources, expense categories, and savings goals. Here are the steps to follow when customizing your free budget template:

- Choose the right budget template.

Select a template that aligns with your budgeting goals and the level of detail you require. Look for templates that are compatible with Excel or PDF formats.

You can also consider using budgeting software or mobile apps that can automatically sync with your bank accounts and credit cards to track your expenses. These tools can streamline the process by categorizing transactions and generating spending reports. - Review and modify income sources.

Identify all your income sources, including salaries, freelance work, side hustles, investments, or rental income. Modify the template to include these income streams, ensuring that you capture your complete financial picture.

Easily make adjustments to the template using a PDF editor or PDF converter tools from Adobe Acrobat online services. - Customize expense categories.

Assess your spending habits and determine which expense categories are most relevant to your budgeting needs. Common categories include housing, utilities, transportation, groceries, entertainment, debt payments, and savings. Add, remove, or modify categories in the template to reflect your specific expenses. - Set realistic budget limits.

Consider your income, financial goals, and spending patterns when setting budget limits for each category. Ensure that your budget is realistic and aligns with your financial circumstances. - Track and monitor your expenses.

Use the template to track your monthly expenses accurately. Regularly input your expenditures into the designated categories. Define your short- and long-term financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. Incorporate these goals into your budget by allocating specific amounts toward each goal. - Analyze and adjust as needed.

Review your budget periodically and analyze your spending patterns. Identify areas where you can cut back or reallocate funds to align with your financial goals. Make savings a priority in your budget. Allocate a portion of your income toward savings before allocating funds to other expense categories. This will help you build a financial safety net and work toward your long-term financial objectives. - Utilize built-in formulas or calculations.

Some free budget templates may have built-in formulas or calculations that automatically sum up your income and expenses, calculate savings, or provide visual representations of your budget. Take advantage of these features to gain insights into your financial progress.

Frequently asked questions.

Creating a monthly budget can be an intimidating process to take on. Here are a few answers to frequently asked questions that can help simplify the process.