7 invoice examples to keep your small business organized

Summary/Overview

While often seen as routine paperwork, invoices are the backbone of financial operations in any small business. They play a pivotal role in creating accountability for and streamlining financial operations, helping to effectively track transactions, optimize cash flow, and ensure smooth customer interactions.

Depending on your type of small business, invoices can take several forms, ranging from standard invoices to specialized varieties, each serving a distinct purpose and contributing to the smooth functioning of commercial transactions.

In this post, we’ll walk you through the importance of understanding how various invoice examples can empower your small business to maintain accurate financial records, establish strong customer relationships, and navigate complex regulatory frameworks to foster transparency, streamline operations, and safeguard your financial well-being.

Why invoices are important to your small business

Meticulous bookkeeping isn’t only for Fortune 500 companies, and it isn’t just for keeping your nose clean come tax season either.

Invoices help build trust within your operation and with outside stakeholders and customers by creating accountability and fostering effective communication. A well-crafted invoice example demonstrates professionalism and clarity to a recipient, providing a reference for addressing customer concerns and questions, helping avoid awkward and unnecessary misunderstandings or disputes.

Beyond streamlining customer experiences, invoices help protect you and your small business, helping ensure timely payments and a healthy cash flow. Promptly issuing invoices establishes clear payment terms, reducing the risk of late or missed payments and unfortunate misunderstandings.

Invoices also serve as critical financial records. They provide detailed transaction information for accurate bookkeeping, tax compliance, and reporting. Organized invoice records help track income, expenses, and outstanding payments, facilitating transparency and informed decision-making.

A solid record of well-designed and easy-to-decipher invoices also protects you and your small business, minimizing financial risks and ensuring legal compliance. They establish formal transaction records, protecting your business's rights and interests. In disputes or legal issues, invoices serve as evidence of agreed-upon terms and compliance with financial regulations and tax codes. Without them, your word won’t hold much weight to a litigious customer or an unsympathetic tax auditor.

Invoices also support financial planning and forecasting. Analyzing invoice data reveals revenue patterns, customer preferences, and seasonal fluctuations. This insight drives informed decisions on pricing, inventory, and marketing strategies. Say you’re appealing to investors or positioning to sell your business — without a solid track record of the correct kind of invoices, you’ve got nothing to prove the expenses and revenue of your operation, making yourself vulnerable to some well-justified skepticism and pushback against your assertions of the viability and value of your small business.

7 types of invoices and when to use them

There's an old adage that states: “The devil is in the details.” However, the more specificity you lend to your invoices, the more your customers, stakeholders, and scrutinizers will think of you and your small business as their guardian angel.

When you’re considering what kind to use, consider questions of timelines, credit and debiting of customer accounts, and quantity of products or hours of professional time spent on a project. The selections below comprise some of the more fundamental invoice examples you may find useful to your small business.

1. Standard invoice

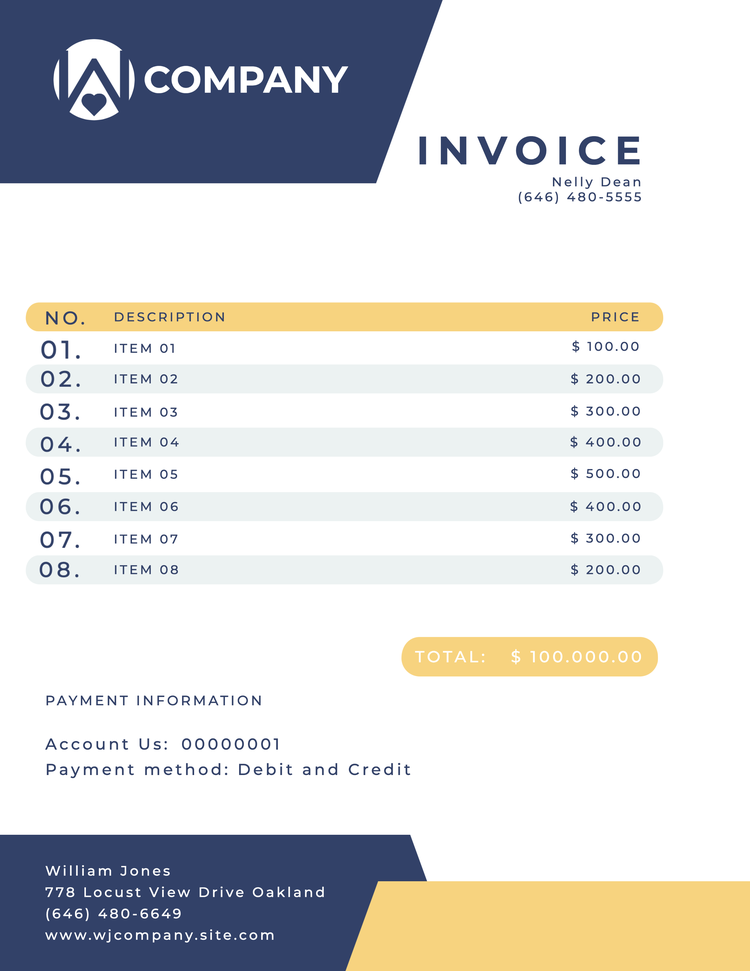

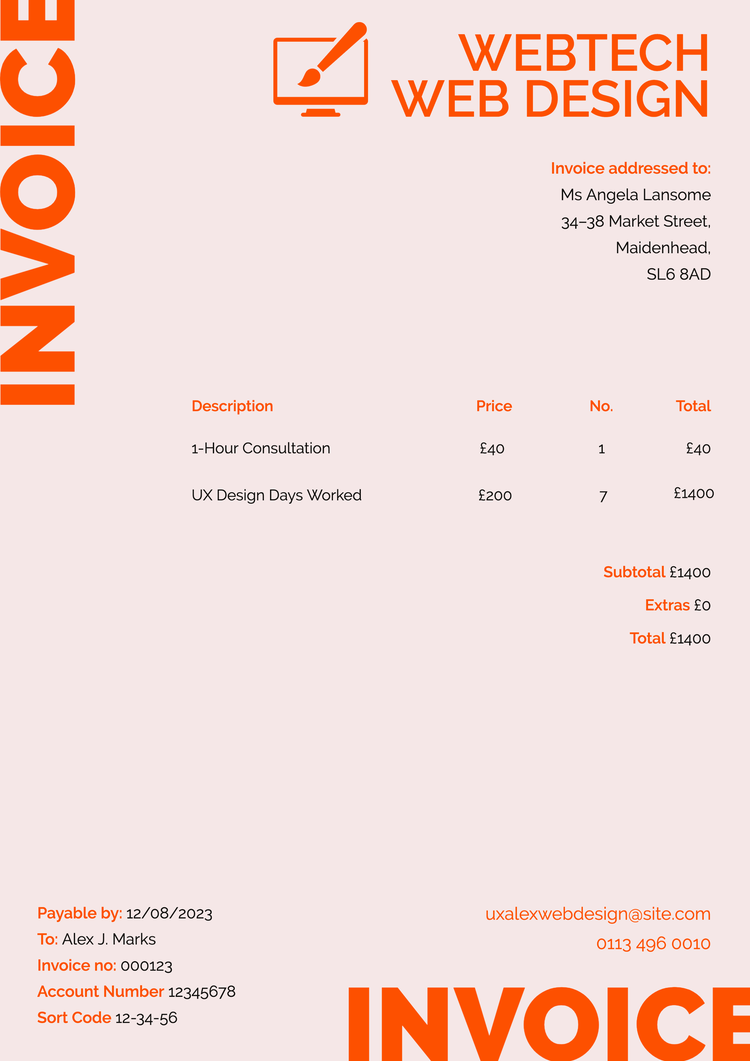

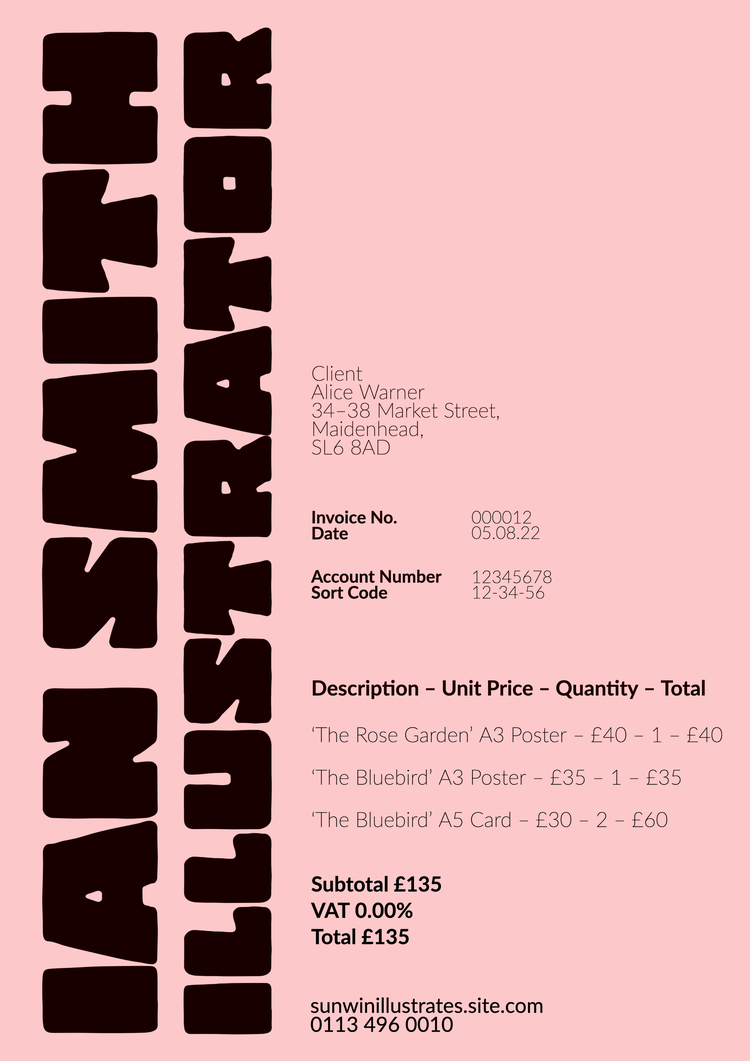

The standard invoice is the fundamental type of invoice used in business transactions. It includes essential information like the seller's details, buyer's details, a detailed description of goods or services provided, quantities, prices, and the total amount due. Standard invoices are widely used across industries and are essential for accurate bookkeeping, establishing payment terms, and resolving disputes.

2. Pro forma invoice

As a way of quoting costs for a customer or client, a pro forma invoice serves as a preliminary outline of the estimated costs and terms of a future transaction by providing an overview of the goods or services, pricing, and other relevant details before a final agreement is reached. Pro forma invoices are especially valuable for international trade, allowing buyers and sellers to confirm terms, obtain necessary permits, and arrange financing.

3. Interim invoice

For projects or services that take place over a more extended period of time, interim invoices help maintain a steady cash flow by billing clients periodically throughout the project's duration. Interim invoices are particularly relevant in industries such as construction, consulting, or software development, where the work carried out is typically measured in stages or milestones.

4. Recurring invoice

In businesses with ongoing service agreements or subscription models, recurring invoices are indispensable. They automate the billing process by generating invoices at predetermined intervals, such as monthly or annually. Recurring invoices streamline administrative tasks and provide a predictable cash flow while ensuring customers are billed accurately and on time.

5. Credit memo

When a buyer returns goods or receives credit for a previous purchase, a credit memo is issued. This type of invoice serves as a record of the credit or refund due to the buyer, reducing the outstanding balance or offsetting future invoices. Credit memos are crucial for maintaining accurate accounting records and reconciling discrepancies between buyers and sellers.

6. Debit memo

Conversely, when additional charges or fees are incurred by a buyer, a debit memo is issued. This type of invoice is used to notify the buyer of the amount due and serves as a record of the additional charge. Debit memos help businesses avoid financial losses by ensuring that all costs associated with a transaction are accounted for and paid up.

7. Commercial invoice

In international trade, commercial invoices are essential for customs and tax purposes. They provide a detailed description of goods, including their origin, value, and quantity. Commercial invoices play a critical role in ensuring smooth customs clearance, accurate assessment of import duties, and compliance with international trade regulations.

Free remixable templates to create your own invoices

With the Adobe Express invoice maker, you can generate beautiful custom invoices from start to finish in just a few minutes — no matter your design experience. Start by browsing through thousands of professionally made templates, then pick one and personalize it. Insert your information, including client details, a list of goods or services, the amount to be paid, and applicable taxes.

Simply open Adobe Express on the web or download the mobile app to get started, or kick off yours with some of the free templates of invoice examples below.