A global exploration of ad effectiveness and engagement

Summary/Overview

Key takeaways

- On average, consumers from Mexico ($82) and South Africa ($79) spend more on ad-inspired purchases compared to other countries surveyed: Germany ($61), Australia ($59), the U.S. ($58), and the U.K. ($41).

- Based on ad-inspired consumer spending across top advertising platforms, ads are most effective on Instagram ($86) and YouTube ($86). Consumers globally are also most likely to interact with ads on these platforms.

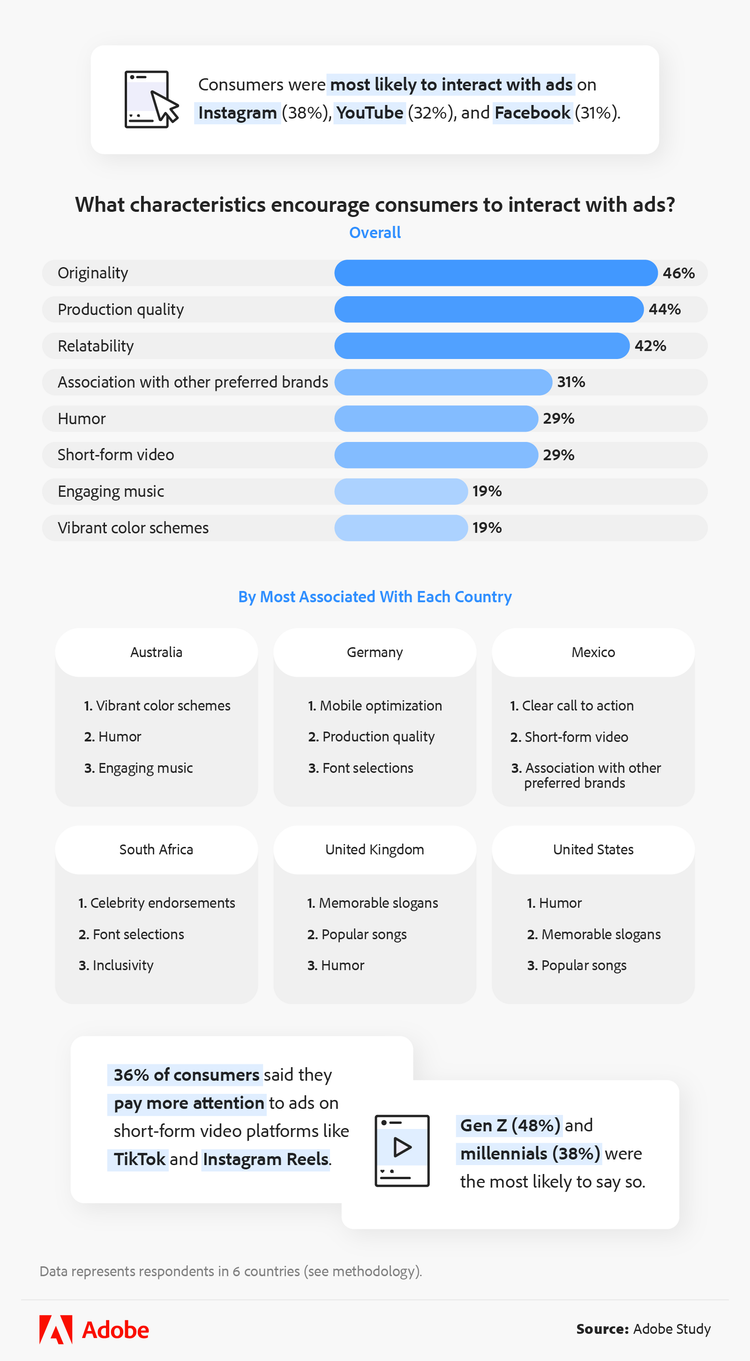

- More than one in three consumers globally are paying more attention to ads on short-form video platforms like TikTok and Instagram Reels. Gen Z (48%) was the most likely to say so.

- Influencer endorsements sway 49% of consumers globally to make a purchase, with Gen Z (60%) being the most likely to do so.

- One in five consumers globally have stopped using YouTube due to an excessive number of ads.

Worldwide advertising trends

In our increasingly digital world saturated with advertisements, capturing consumer attention requires understanding genuine audience engagement. To discover the keys to worldwide advertising success, we’ve conducted a global survey asking 1,010 consumers about the ads they interact with, including where they come across them, how much money ads lead them to spend, and which platforms have too many. This article lays out our insights about modern advertising.

Ad effectiveness across platforms

What captivates audiences and inspires purchases is constantly changing. Let’s see which platforms have been hitting that sweet spot with global consumers lately.

Many consumers (78%) have been inspired to buy something after viewing an ad about it. Consumers globally most often saw ads that led them to make a purchase on the following platforms, ranked from highest to lowest engagement:

- YouTube

- TikTok

- Amazon

- TV

Instagram users spent an average of $86 on an ad-inspired purchase. However, higher engagement didn’t always lead to higher spending.

Though ranked third for inspiring consumer spending, YouTube matched Instagram’s average spend of $86, underscoring the power of video content in today’s advertising arena. And while Amazon ranked sixth in spending inspiration, it came in third for the average amount spent after seeing an ad on its platform ($80).

Looking at how much consumers in different parts of the world have spent, Mexico ($82) and South Africa ($79) spent much more on average for purchases inspired by ads compared to other countries such as Germany ($61), Australia ($59), the U.S. ($58), and the U.K. ($41).

Our global perspective also revealed other trends in platform preferences. Instagram reigned in Mexico and Germany, with a respective 64% and 50% saying they interact with ads there the most. Meanwhile, Australia and the U.K. showed a strong affinity for Facebook (both 34%), but South Africa (61%) and the U.S. (31%) leaned more toward YouTube.

Consumers globally were also more likely to interact with Instagram ads than those on any other platform. Of the over 1,000 people we surveyed across six countries, 38% had interacted with an Instagram ad, followed by YouTube (32%) and Facebook ads (31%).

What is it about the ads on these platforms that fuel user interaction? According to our respondents, the key drivers tend to be originality, high-quality production, and relatability. Production quality was most important to Gen Z respondents (53%), contrasting sharply with baby boomers, who were the least influenced by it (25%).

Another factor could be the short length of Instagram video ads. Short-form video content is easy to produce, making it accessible to marketers of a wide range of skill and resource levels. As a result, these videos are becoming more widespread, and we found that they’re catching increasing attention: more than one in three consumers globally said they’re paying more attention to ads on short-form video platforms like TikTok and Instagram Reels — especially Gen Z (48%).

The ad types that really work

Next, based on our survey, we’ll dig into the types of marketing consumers are most attracted to. Pro tip: keep it authentic.

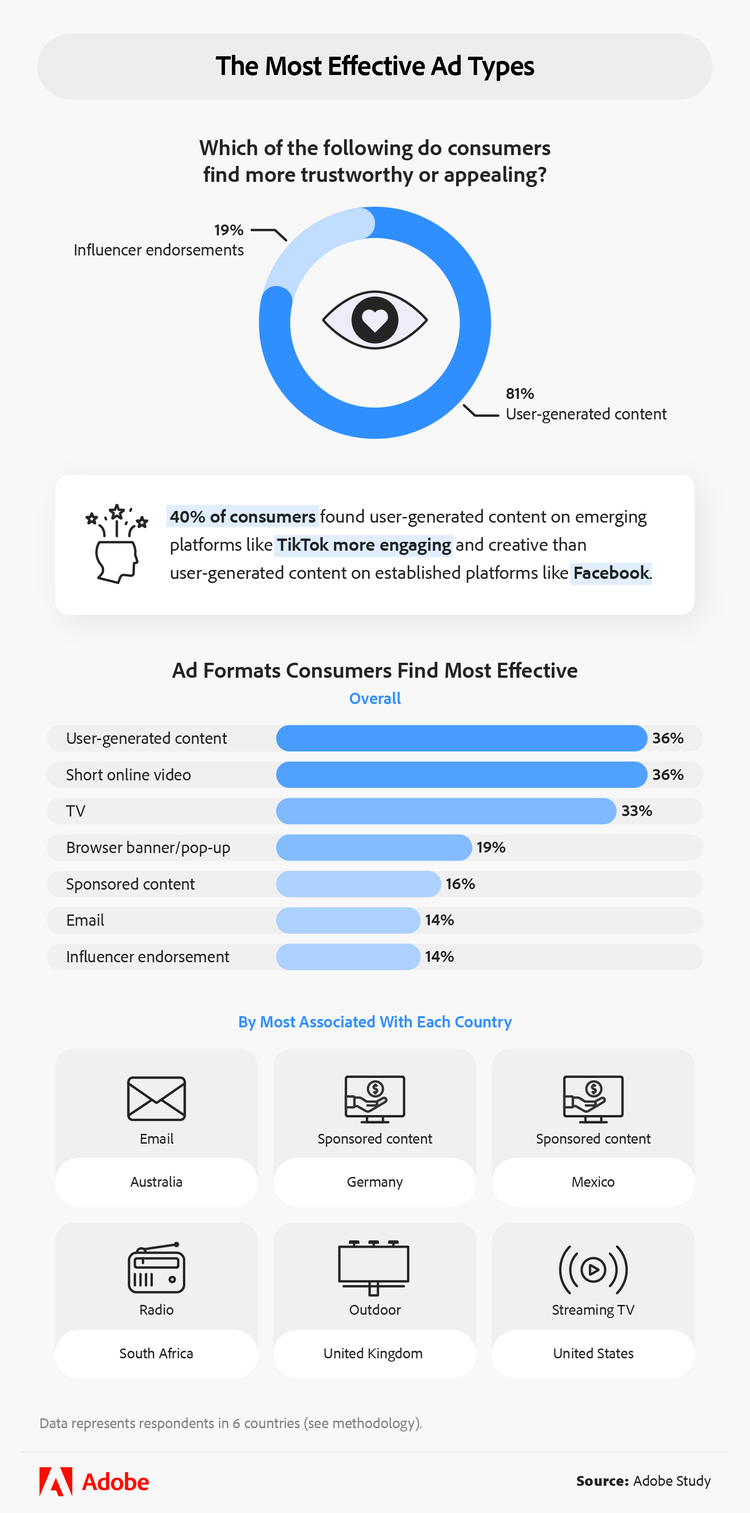

When asked who creates the most trustworthy or appealing content, 81% of respondents chose user-generated content over influencer endorsements. This suggests a shift toward more authentic advertising as savvy consumers know that many influencers are well-paid for their product recommendations.

However, younger generations — the demographics most pivotal in shaping future trends — had different opinions. Gen Z was the generation most likely to trust influencer endorsements (26%). Those percentages contrasted starkly with the 8% of baby boomers and 8% of Gen X who shared that feeling.

Still, according to respondents overall, user-generated content is the most effective ad format (36%). The same number found short online video content most effective, especially Gen Z (49%). This inclination among the youngest consumers suggests evolving media consumption habits, differing markedly from those of baby boomers and Gen X. About half of respondents in these older generations said they still find traditional TV commercials to be some of the most compelling ads, compared to only 28% of millennials and 26% of Gen Z.

Sponsored content was also a top choice for some respondents (16%), especially in Germany and Mexico. This type of marketing content grabs consumer attention by demonstrating a trusted partnership between the promoted brand and its sponsor, giving it credibility. For example, when a blogger writes a post featuring a product that aligns with their readers’ interests, the audience is likely to trust their recommendation.

But, some demographics preferred video content, including streaming TV ads. U.S. consumers were the most associated with the opinion that these videos — also known as over-the-top (OTT) ads — shown on streaming services are the most effective.

Regardless of ad format, influencers’ power to drive consumer behavior cannot be overstated. Nearly half of consumers globally have been swayed by their recommendations, with Gen Z being most likely to have made a purchase based on them (60%). Social media platforms are key for engaging with Gen Zers, as influencers significantly drive engagement and purchasing through these channels. This trend reaches its zenith in South Africa, where 63% have made purchases based on influencer endorsements, while U.K. respondents exhibited more skepticism, with only 34% swayed by such recommendations.

A warning against advertising overload

There’s a delicate balance between effective advertising and viewer satisfaction, and ad-saturated platforms can often tip the scales unfavorably. Our survey uncovered why that may be and what the consequences are.

Nearly half of consumers globally said they have abandoned a platform due to excessive advertising. YouTube was the leading cause of this exodus, with 21% of users having stepped away because of too many ads; this was especially common in Mexico (29%). Some respondents also quit Facebook (18%) due to excessive advertising, particularly in the U.K., where one in four people reported doing so.

The dissatisfaction with ad saturation cut across age groups as well. Even one in six Gen Zers, known for their heavy TikTok use, abandoned their most beloved social media platform when it bombarded them with too many ads. They were also the generation most likely to have removed a mobile app for that reason (79%) compared to the rest of our respondents (72%).

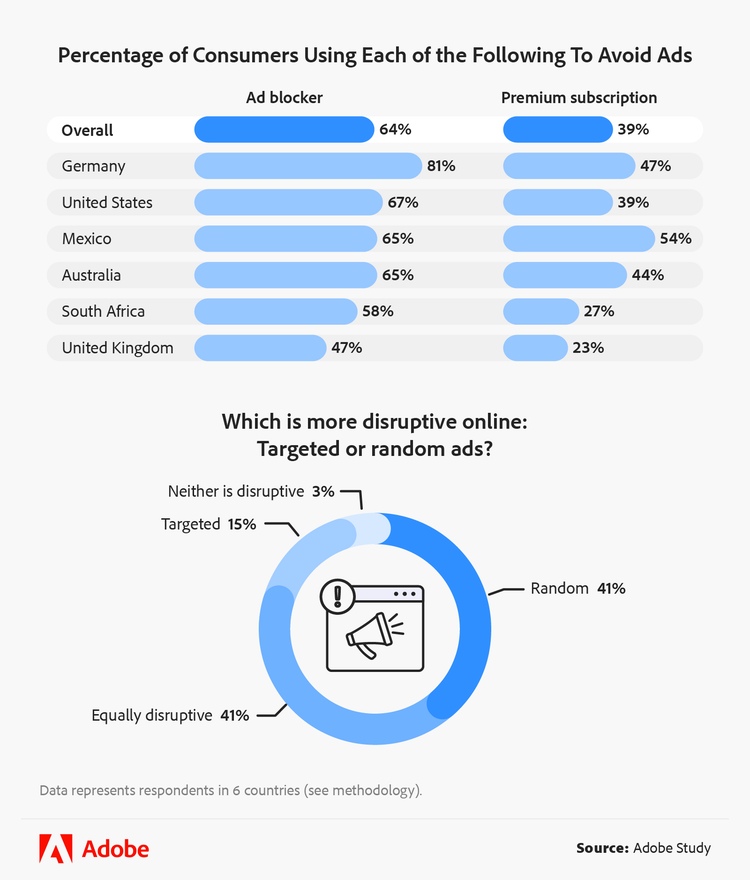

Most consumers globally (80%) agreed that ads disrupt their browsing experience, regardless of the type or format. Those in Mexico were most likely to say so (87%), as was Gen Z (84%). However, the debate around random versus targeted ads was also part of the user satisfaction equation.

When a consumer sees an ad for a product or service they actually want and can use, it can be as helpful for them as it is for marketers. Likewise, our survey responses suggest that random ads are more disruptive to the online experience (41%) than targeted ads (15%). This sentiment was also strongest among Mexican consumers — reported by more than half.

Innovation in advertising

Being successful in the multifaceted world of digital advertising requires a careful balance between quality and quantity. Overall, our findings suggest that original, user-generated content delivered in a short video format is a solid bet for attracting the most attention from a worldwide audience. Advertisers would do well to fine-tune their strategies to resonate with the right audiences without overloading them with ads or disrupting their experience. One thing’s for sure: the future of advertising success lies in authenticity, creativity, and aligning with the evolving expectations of a diverse global audience.

Methodology

To reveal global advertising trends and audience preferences, we conducted a survey of 1,010 participants from various countries and gained insights into ad perceptions worldwide. Of our sample, 30% of respondents were in the U.S., while Australia, Germany, Mexico, South Africa, and the U.K. respondents each comprised 14%. Generationally, Gen Z made up 30%, millennials 48%, Gen X 17%, and baby boomers 6% (percentages don’t total to 100 due to rounding.)

Fair use statement

If you find these advertising insights valuable, feel free to share them for any noncommercial purpose. We just ask that you kindly include a link back to this page for full access to our study and methodology.