Review of 2017: Digital-First Organisations More Likely To Have Exceeded Business Goals.

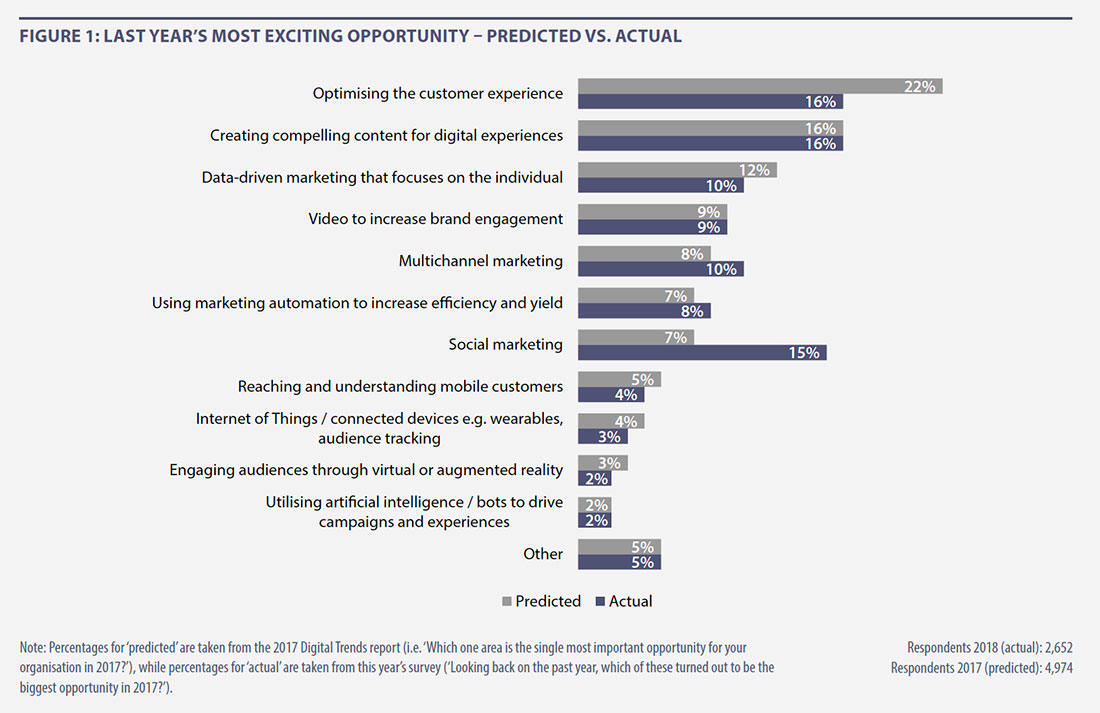

The Digital Trends report, published by Econsultancy in partnership with Adobe, is based on the largest global survey of its kind, with almost 13,000 marketers and digital professionals taking part. Before outlining the key trends of 2018, it is instructive to see how the perspective on last year’s biggest digital opportunities has changed with the benefit of hindsight (Figure 1).

Last year1 more than a fifth (22%) of respondents said that optimising the customer experience would be the single most important opportunity for their organisation in 2017, ahead of creating compelling content for digital experiences (16%) and data-driven marketing that focuses on the individual (12%).

While customer experience optimisation did indeed transpire to be a top opportunity, it lost ground to the creation of compelling content which lived up to its billing as the second most exciting area of focus. Each of these opportunities, which are by no means mutually exclusive, garnered 16% of the vote.

Social marketing, meanwhile, has significantly over-indexed against last year’s predictions, as indeed was the case a year ago when we looked back on 2016. According to Statista2, there will be more than 2.5 billion worldwide social media users by the end of this year, with the number continuing to climb as more people acquire smartphones and seek to connect and communicate through platforms such as Facebook, Instagram, WeChat and Sina Weibo.

Social marketing is the gift that keeps on giving for marketers who continue to explore ways of harnessing both paid-for and organic social media. However, given Facebook’s recent announcement about newsfeed prioritisation of posts from friends and family, it will be interesting to see this year whether this sounds the death knell for organic social activity on Facebook, as some commentators are predicting3.

The gap between the proportion of respondents who predicted that data-driven marketing would emerge as the top opportunity (12%), and the number of those who actually saw this transpire (10%), has now closed to only two percentage points, down from eight percentage points last year, when the equivalent figures were 16% and 8%. As with creation of compelling content, this type of approach is inextricably linked with improvement of the customer experience.

Like social marketing, multichannel marketing is a discipline that outperformed against expectation as an opportunity last year (8% predicted, vs. 10% actual). Many organisations continue to reap the benefits of a more joined-up approach to their marketing activities across a range of digital and offline channels. Improvements to marketing platforms and the increased ability to achieve a single customer view – or at least something close to that – have enabled many businesses to benefit from orchestrated marketing campaigns that provide a more consistent and synchronised experience for users.

On a similar theme, using marketing automation to increase efficiency and yield also met expectations (7% predicted, vs. 8% actual). This is more evidence that the promise of more automation of time-consuming marketing tasks to improve marketing performance is becoming a reality. The benefits of marketing automation are currently more apparent in the world of B2B, with 11% of these respondents citing this as the biggest opportunity in 2018.

While they have been talked about for many years, Figure 1 shows that areas such as the Internet of Things (IoT), virtual or augmented reality, and utilising artificial intelligence / bots are still very much the preserve of early adopters. A combined total of only 7% describe these areas as last year’s biggest opportunity, showing there is huge scope for marketers to engage with these types of technology more extensively. AI is explored more fully in Section 10 of this report.

Business Performance

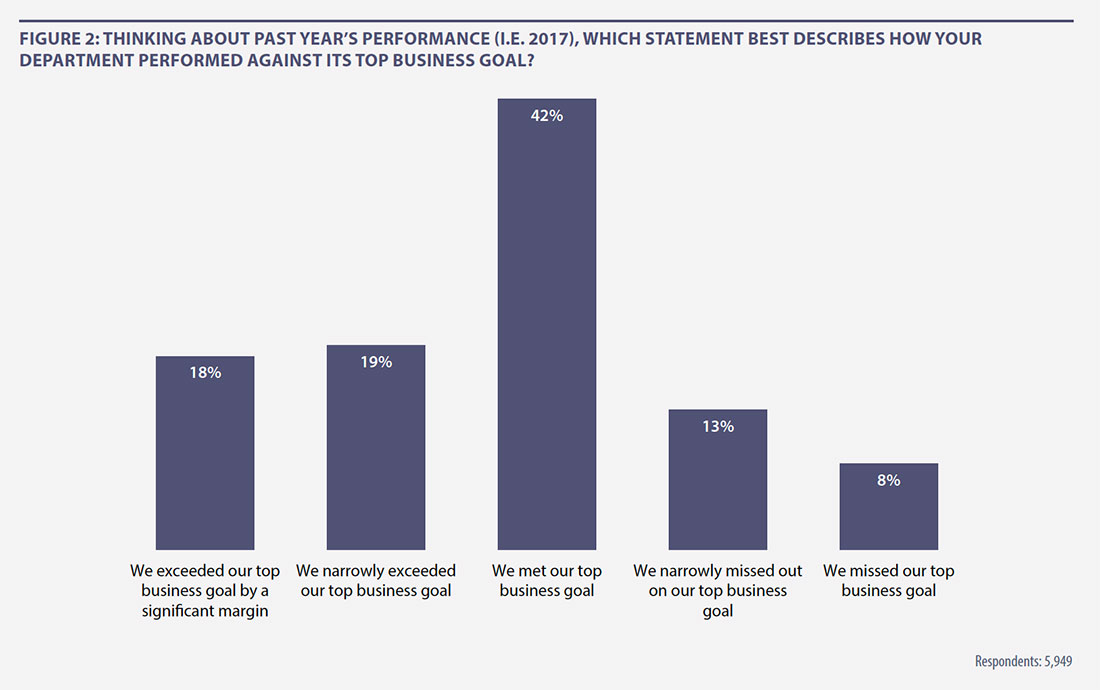

This year’s report sees the introduction of a new question to ascertain how company respondents view their department’s 2017 performance in the context of their top business goal (Figure 2). Used in tandem with a question about how companies are performing against their competitors (see Figure 33 in the Appendix), we have identified the most successful organisations to understand what top-performing companies are doing differently from their peers.

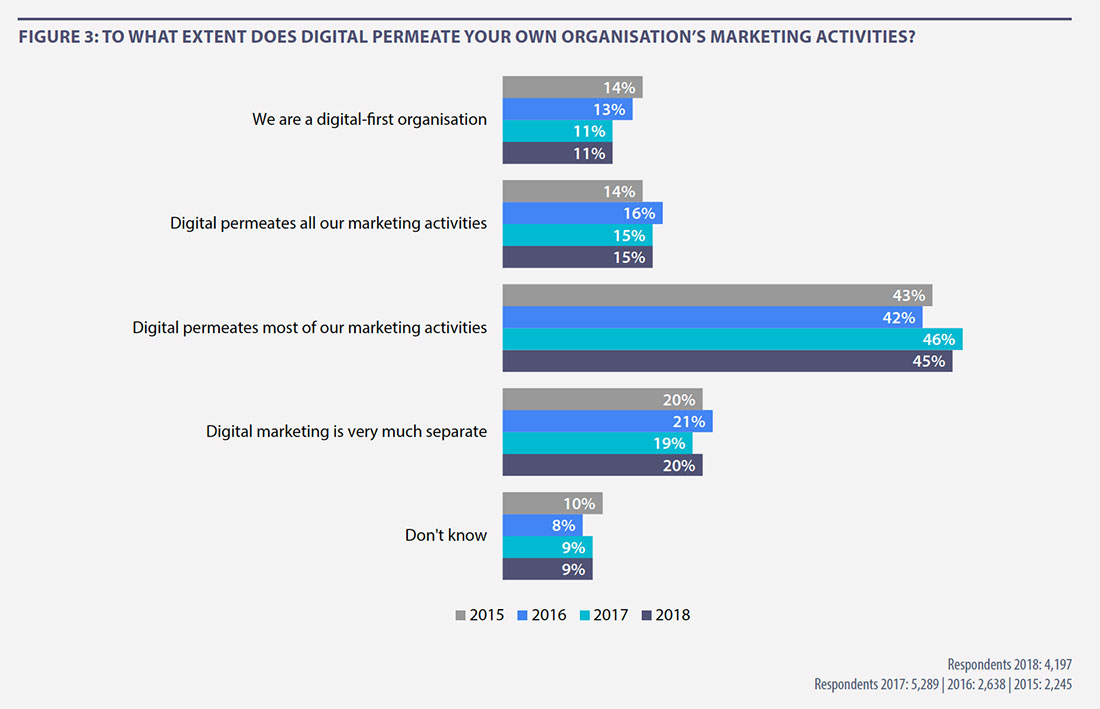

A key finding from the research is that top-performing companies are twice as likely as their peers to classify themselves as digital-first (18% versus 9%). As can be seen in Figure 3, digital-first organisations amount to 11% of companies that took part in this research globally, a percentage that has declined from 14% in 2015. While a digital-first approach is not necessarily something that all businesses should aspire to, the benefits for those who have achieved this are apparent.

Almost twice as many companies (20%) say their digital marketing activity is very much separate than digital-first (11%), with these organisations seemingly unable to break out of a siloed business structure that ultimately impedes their chances of success. Further analysis shows that companies in the Asia Pacific (APAC) region are 50% more likely than their counterparts in North America to have a separate digital marketing function (24% compared to 16%).

At a global level, as has been the case in previous years, survey respondents are most likely to say that digital permeates most marketing activities (45%).

1 Digital Trends 2017

2 Number of global social network users 2010-2021

3 Digiday