Companies get quantifiable uplift from customer-centric approach… it’s the year of CX again

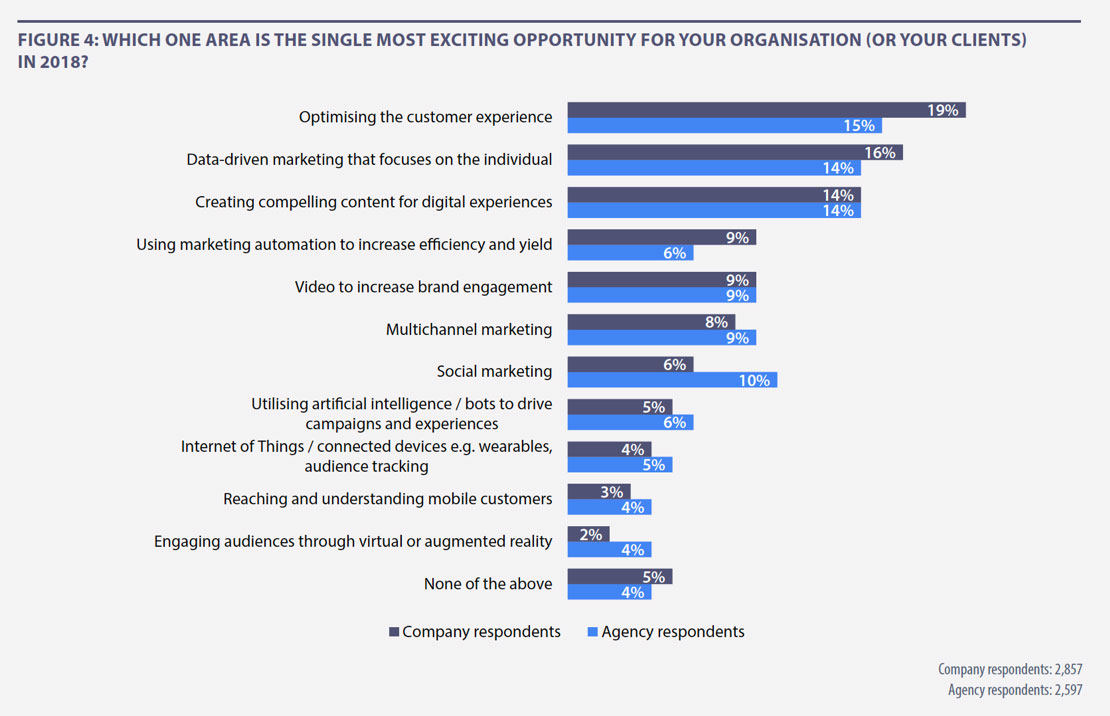

After our review of how 2017 matched up against expectations, it’s now time to see what is top of the agenda for 2018. Optimisation of the customer experience again comes out on top, with just under a fifth (19%) of respondents saying that this is the most exciting opportunity (Figure 4). While there has been a statistically significant drop from 22% since 2017 (Figure 1), this doesn’t mean that CX has become less important. Rather, some companies are more focused on other, more specific, opportunities, all of which feed into the overall customer experience, to a greater or lesser extent.

A good example of this is data-driven marketing which, from the perspective of client-side respondents, has climbed from 12% in 2017 to 16% for 2018. This suggests that companies are redoubling their efforts in this area after a year of frustration. With the benefit of hindsight, only 10% saw this to be the biggest opportunity in 2017 (Figure 1).

Companies continue to reap the benefits of a data-driven approach to marketing, with a more rigorous and scientific approach helping marketers to spend their precious budgets more effectively, and to justify the impact of their investment to safeguard and increase their budgets in the future.

Although many companies may now be better equipped in terms of skills and technology to make this aspiration a reality, it should be acknowledged that data-driven marketing does not represent a Holy Grail for everyone. While marketing should certainly be powered by data, creativity and intuition are key components for effective marketing and creation of great customer experiences. Not wanting to underplay the importance of data, ‘data-informed marketing’ may be a better phrase than ‘data-driven marketing’.

Customer experience can be defined as the complete set of interactions and engagements that a customer has with a brand, including online touchpoints such as video views, mobile and desktop content consumption, ecommerce transactions and emerging technologies such as chatbots and connected IoT devices, as well as offline touchpoints such as in-store, in-branch, outdoor and experiential advertising.

There is a wealth of research to show that an improved customer experience will pay dividends by delivering better business performance. According to the 2016 Temkin Experience Ratings4, companies that are categorised as ‘experience leaders’ have net promoter scores 22% higher than those rated as ‘experience laggards’, showing that the better the customer experience, the more likely people are to recommend a brand.

Just as compellingly, the Reinventing Loyalty report5, published in 2017 by Goldsmiths University in partnership with Adobe, found that nearly two-thirds (61%) of 5,000 European consumers surveyed agreed they felt loyal to brands that tailored their experiences to their preferences and needs. Furthermore, 51% said they would buy from a brand they had never heard of before if a better offer and experience was provided.

Research for this Digital Trends report highlights the value of a customer-centric approach, showing that organisations with ‘a cohesive plan, long-term view and executive support for the future of their customer’ are more than twice as likely as their peers to significantly outperform their competitors (27% vs. 13%).

While the importance of customer experience is now widely accepted, companies face an ongoing challenge to ensure that they have the right building blocks in place to facilitate this.

According to Jamie Brighton, Head of Product Marketing for Adobe Experience Cloud in EMEA6: “Too many brands become paralysed by not knowing where to start or how to approach the adoption of a customer-centric strategy. Essentially, digital transformation is about people, process and technology, and you need the right mix of skills and an environment for people to flourish in, as well as the right technology to enable them.”

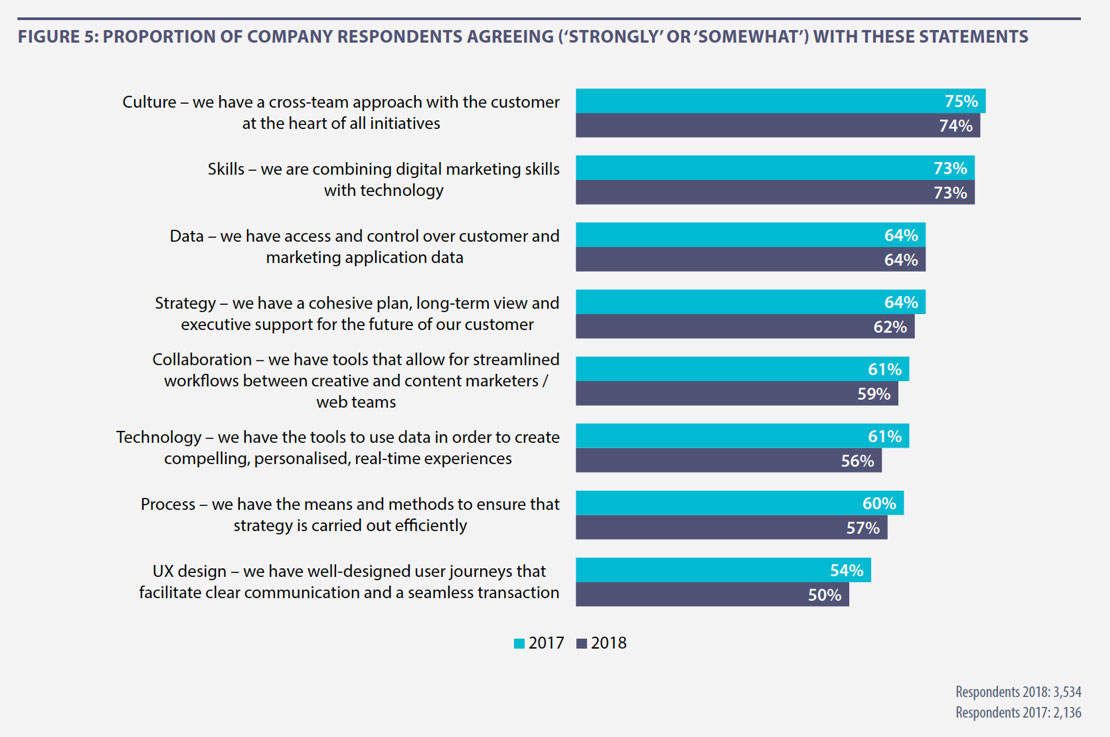

Figure 5 shows a whole range of areas that organisations need to address, and the percentages of respondents who agree in each instance that they have the necessary capabilities. The importance of a strategy that underpins CX efforts cannot be overstated. Just under two-thirds (62%) of respondents agree they have a cohesive plan, long-term view and executive support for the future of their customer, only a slight decrease from 64% in 2017.

While marketers can play a key role in leading the CX charge, the ability to delight customers transcends the marketing function. The right cultural environment is another critical requirement for success, with three-quarters (74%) of respondents agreeing that they have a ‘cross-team approach with the customer at the heart of all initiatives’, down marginally from 75% in 2017. Tellingly, those organisations that have this type of approach are nearly twice as likely as their peers to be exceeding their business goals by a significant margin (20% vs. 11%).

A cross-team approach ultimately means ensuring that employees are motivated to work together across departments in order to bring about the best experience for customers. It is important for businesses to reward employees based on their ability to collaborate with people in other teams. The right behaviour depends on the right rewards and bonuses. Ultimately, you get the behaviour you measure.

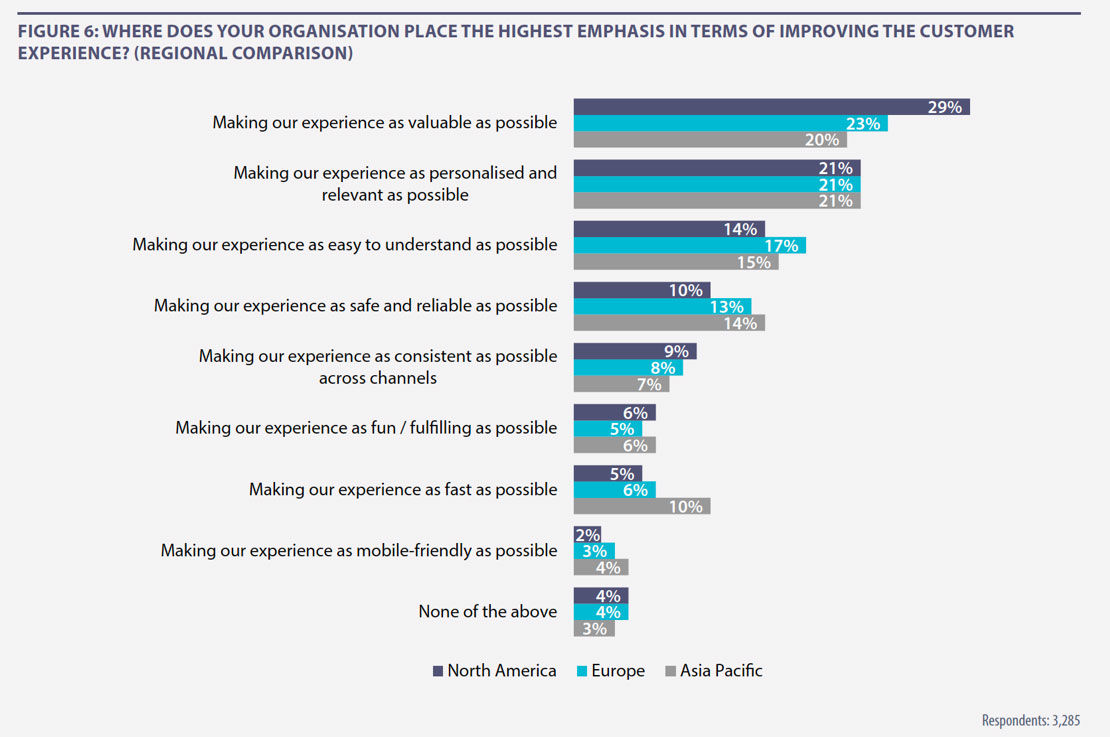

Figure 6 shows where companies in different regions are putting most emphasis when it comes to improving CX. For North American and European respondents, the main focus is on making the experience as valuable as possible (29% and 23% respectively), whereas those in APAC are most likely to focus on making the experience as personalised and relevant as possible (21%). APAC survey respondents are more likely than their peers in other regions to prioritise the safety and reliability of the experience, and also the speed of the experience.

The emphasis on value in North America suggests a greater appreciation of the importance of differentiating through the customer experience, likely resulting from more competition across many business sectors in North America where a sub-standard CX is simply not commercially viable.

A key finding from the research is that top-performing companies are twice as likely as their peers to classify themselves as digital-first (18% versus 9%). As can be seen in Figure 3, digital-first organisations amount to 11% of companies that took part in this research globally, a percentage that has declined from 14% in 2015. While a digital-first approach is not necessarily something that all businesses should aspire to, the benefits for those who have achieved this are apparent.

Almost twice as many companies (20%) say their digital marketing activity is very much separate than digital-first (11%), with these organisations seemingly unable to break out of a siloed business structure that ultimately impedes their chances of success. Further analysis shows that companies in the Asia Pacific (APAC) region are 50% more likely than their counterparts in North America to have a separate digital marketing function (24% compared to 16%).

At a global level, as has been the case in previous years, survey respondents are most likely to say that digital permeates most marketing activities (45%).

4 XM Institude

5 Adobe Goldsmiths Reinventing Loyalty Report

6 Delivering effective digital customer experiences