Ability to measure ROI helps boost digital marketing investment

As we move into another year in digital marketing, the foundations for success appear increasingly robust. Companies continue to demonstrate their confidence in digital marketing techniques by backing marketers with additional budget. Around two-thirds (66%) of company respondents say they plan to increase digital marketing spending in 2018, a slight (two-percentage-point) improvement on the already-impressive figure reported in 2017. Only 6% of respondents say their companies are planning to decrease spend.

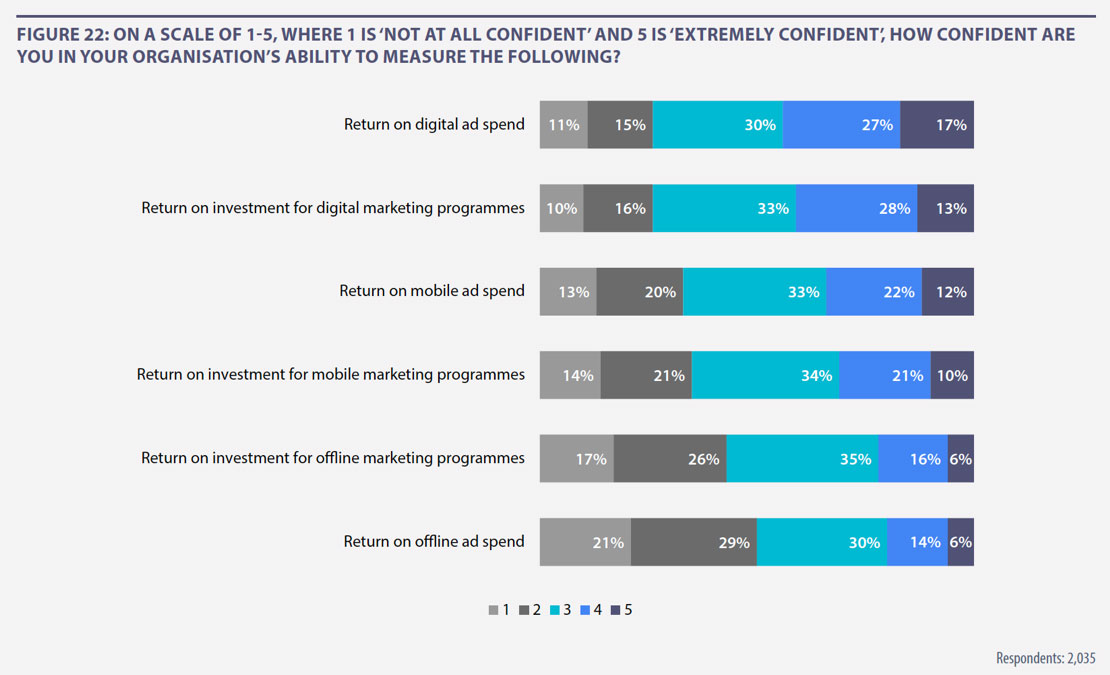

The results are strikingly consistent across regions (Figure 20), emphasising digital marketing’s increased levels of maturity all over the world. The level of investment points to a supporter base of which many industries would be envious. A significant majority of companies are reaping demonstrable benefits and are prepared to invest more. While there are some marketers reining in budget, it is inevitable that some practitioners will be unable to unlock performance, or are being forced to reduce spend for reasons unrelated to digital marketing ROI.

It is clear that business success breeds further digital investment which, in turn, breeds further success. Organisations that have exceeded their 2017 business goals by a significant margin are 12% more likely to be increasing their digital marketing spend (73% vs. 65%) for the year ahead.

The content arms race continues

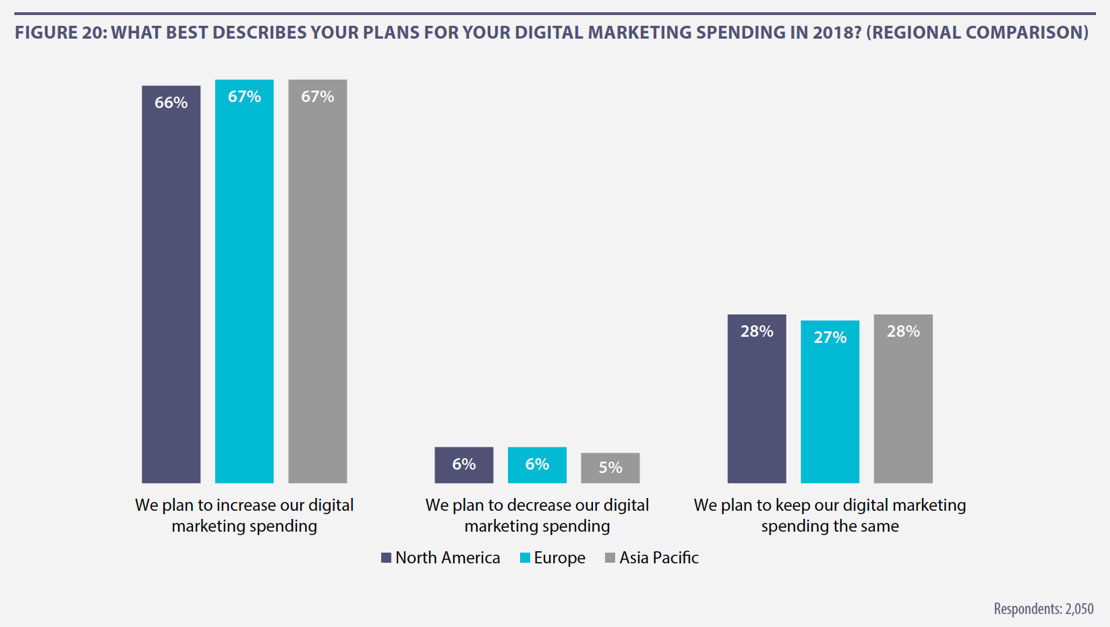

Drilling into marketers’ spending priorities for 2018, the report again demonstrates the burgeoning role of content as a differentiator in digital marketing (Figure 21). This year, marketers will continue to focus heavily on creating compelling and useful content that can enrich the customer experience, and grease the wheels for acquisition, retention and conversion.

While content management refers to the creation and modification of digital content, content marketing is about the distribution and promotion of that content to the right audiences. Content marketing (58%) is the area where respondents are most likely to be planning a budget increase during 2018, while content management is also being allocated greater investment by a significant proportion of marketers (48%). These trends are consistent across regions.

As noted previously, investment in content – or, indeed, any digital asset – is nothing without an understanding of the ‘why’, with insight into how it will help or engage customers, and ultimately drive sales. This is reflected by the presence of marketing analytics (including testing) near the top of the fiscal priority table for 2018. More than half (51%) of respondents plan to increase budget in this area, up from 49% in 2017. This level of interest is, again, repeated across all regions.

Back to the future with search

Another finding of note is the evidence of a renewed focus on search marketing, despite the huge range of options now available to marketers in terms of spend allocation.

Paid search (PPC) has seen the largest jump in the proportion of marketers planning to increase budget for 2018 (by eight percentage points, to 40%). This is a particularly noticeable trend in North America, where 43% of respondents are putting more money on the PPC table. Across all regions, search engine optimisation is also set to see greater spend than in 2017 (47%, up from 45%).

It could be that marketers are turning back to search – an area where they have long-established expertise, systems and processes – after recent and well-publicised transparency and measurement issues in ‘newer’ channels such as programmatic display and video advertising.

Consumers continue to rely on search, both for researching and buying both products and services. Mobile search is becoming increasingly important in our daily lives, as we seek out immediate answers to questions on the spur of the moment and while we are on the move. While mobile search is important for research, it is also often the first touchpoint when consumers want to buy something. According to Google, smartphone users are increasingly likely to purchase something immediately while using their smartphone, especially from companies whose mobile sites or apps are customised with local information13.

Display advertising is the area where most marketers are planning to reduce budget (15%). It will be interesting to see whether display advertising will regain some lost ground in the next few months, given the improvements in the data, metrics and tools available for brands to mitigate concerns around transparency and ad fraud, while also improving their ability to personalise messaging to make advertising more relevant.

Furthermore, advances in data techniques and new measurement capabilities are allowing advertisers to understand the true value of their overall digital media investment rather than focusing only on what have historically been more measurable channels such as paid search advertising.

While search is set to fare well this year, other tried and trusted marketing techniques are not ostensibly seeing the same level of backing. At first glance, for example, email marketing is still not feeling the love in the same way as other channels, despite the demonstrable returns it can offer. As Figure 21 shows, fewer marketers are planning to increase spending on email marketing in 2018 than in 2017 (44%, down two percentage points). This is despite the fact that Econsultancy’s 2017 Email Marketing Industry Census14 highlighted email marketing as the most effective marketing channel, with 73% of respondents deeming its ROI ‘excellent’ or ‘good’.

One explanation for email’s drop could merely be its increased integration with other marketing systems and capabilities, and that this trend towards joined-up capabilities bodes well for its future. Noticeably, 2018 will see increased budgetary impetus for marketing automation (50%, up from 46%) and personalisation (55%, up from 51%). Both these disciplines have close links with email marketing, with the potential to help brands get the right messaging to the right user at the right time. They are, however, technically and organisationally challenging, and potentially hoover up budget if companies don’t have the right platforms and know-how in place.

Instead of allocating cash merely to increase email volume, it seems plausible to conclude that many marketers are directing budget to build the human and technical foundations that could increase its effectiveness further, as well as driving broader marketing gains.

Measurability still a work-in-progress

The increased spending directed towards digital marketing techniques that have inherent measurability, such as paid search, shows that the capability to accurately track ROI remains vital to marketers.

Companies must strive for a holistic view of their total digital investment and how different channels work together, rather than giving too much credit to activities which are more measurable in isolation, such as paid search and paid social.

Organisations that are confident in measuring their return on digital ad spend are nearly twice as likely as their peers to have exceeded their 2017 business goals by a significant margin (29% vs. 15%). This gap is even more evident for those that are confident in measuring their ROI for digital marketing programmes (30% vs. 14%).

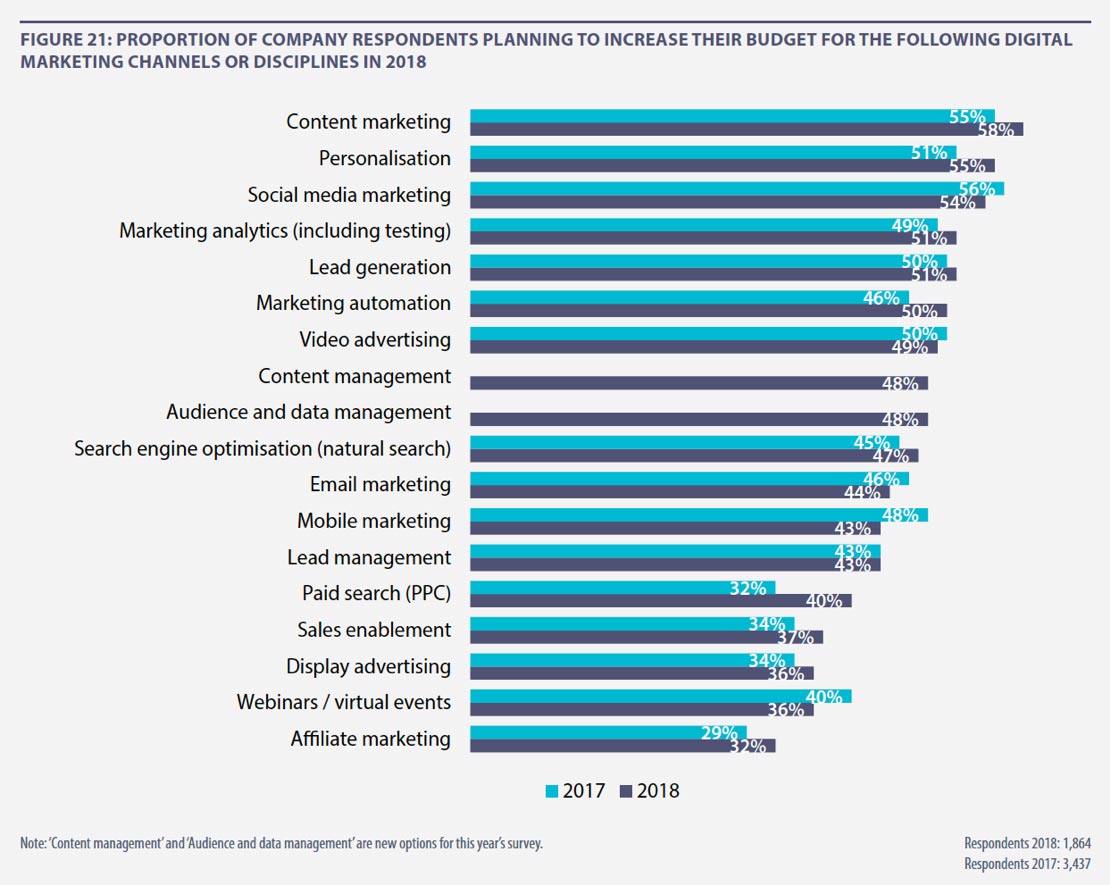

Yet Figure 22 shows there remains a lot of ground to cover, and complexity to work through, for marketing to demonstrate tangible ROI in all its forms. Only a minority of respondents rate their confidence in measurability of digital advertising and marketing programmes a ‘4’ or ‘5’ on a five-point scale (44% and 41%, respectively). These figures drop further for mobile campaigns.

Predictably, digital channels comfortably exceed offline alternatives in terms of accountability, but this is not necessarily a cause for optimism among digital proponents, considering the propensity of boardrooms to hold digital advertising up to higher levels of scrutiny than offline channels which are more well established even if outcomes are less measurable.

More worryingly, organisations haven’t made much progress since last year: across the board, marketers are less likely to report confidence at the higher end of the scale. The only exception is confidence in measuring digital ad spend ROI, which remained stable at 44% (rating of ‘4’ or ‘5’). Following a surge in confidence in 2017, marketers are now more realistic about their ability to measure ROI effectively.

It is important for brands to have a full view of their total digital investment in terms of how digital and more traditional forms of advertising work together. Organisations need to develop measurement capabilities that allow them to optimise their investment against metrics that drive value for the business, instead of vanity metrics and standard KPIs that don’t give a true view on sales.