Investment in digital skills and education pays dividends

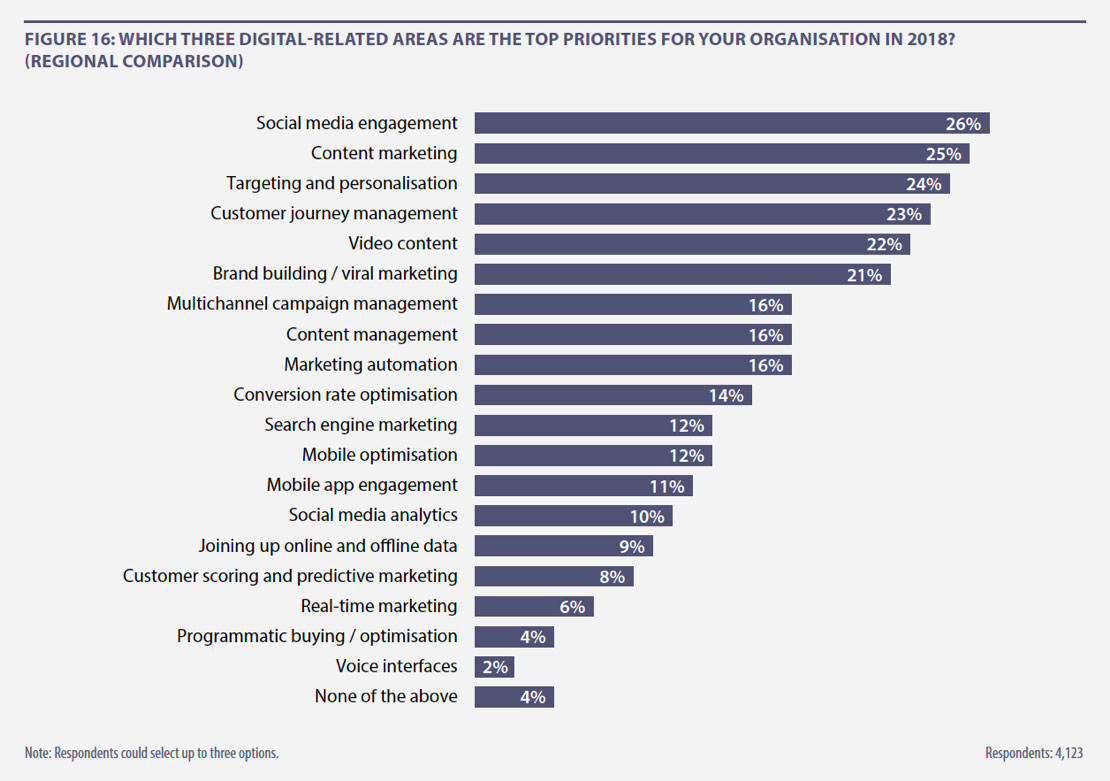

As part of this research we have classified 9% of our sample as the top performers, defined as those companies that exceeded their top 2017 business goal by a significant margin (Figure 2) and who are significantly outperforming their competitors (Figure 33). It is abundantly clear from Figure 14 that significant investment in digital skills and training is strongly correlated with high performance, with top-performing companies twice as likely to be investing significantly in digital skills and education during the coming year (45% vs. 23%).

Digital marketing and ecommerce have evolved hugely in the last few years, with specialist skills increasingly required for individual marketing channels and corresponding tools and platforms.

Companies need to ensure they have a balance of skills between the analytical thinkers who can draw insights from data, and the creative talent to bring marketing and advertising campaigns to life.

Organisations must ensure that they are keeping their employees up-to-speed with the latest trends and technologies, whether through internal face-to-face and online training courses, or one-to-one mentoring and coaching in specific skillsets. Third-party companies such as technology vendors, agencies and independent training companies can also help to ensure that upskilling requirements are catered for.

The temptation for businesses is to neglect skills and training if they are struggling commercially, because they don’t have such readily available budget as their more successful counterparts. However, this is ultimately a false economy because the level of employee performance required to drive commercial success can only be achieved if staff have the right training and skills to succeed.

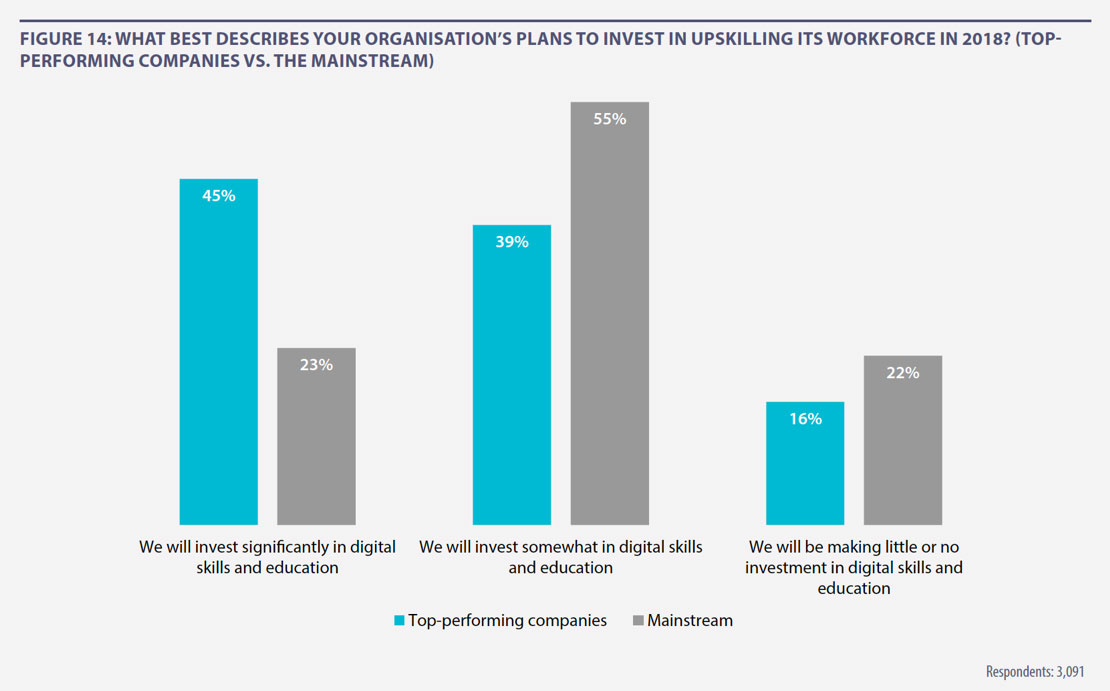

Figure 15 shows that the intended level of digital training investment for 2018 differs greatly by region. Respondents in Asia Pacific are more than twice as likely as their North American counterparts to say they will be investing significantly (34% vs. 16%), while those in Europe fall in the middle (25%). A hypothesis could be that companies in North America have been at the forefront of many of the latest trends, including use of increasingly sophisticated marketing technology. It may be that less investment is required by these companies because ongoing training and skills development is regarded as business as usual.

Although there are some leading digital technology companies based in APAC, many organisations in this region are starting from a much smaller base of digital activity in the past, and their definition of ‘significant’ may differ from their counterparts in EMEA and North America. Nonetheless, it does show that APAC companies recognise that digital skills and training are important considerations, even though investment is likely to be heavily scrutinised for financial value and benefit by those holding the company purse strings.

Looking at the level of investment through the lens of company size, 30% of companies with annual revenues of more than £150m are planning to invest significantly in digital skills and education, compared to 25% of their smaller counterparts.

Digital skills are now inextricably linked to a range of marketing tools and platforms. It was seen in Figure 5 that 73% of respondents agree that their companies are ‘combining digital marketing skills with technology’. Companies doing this are nearly twice as likely to have surpassed their 2017 business goals by a significant margin (20% vs. 11%), according to our analysis.

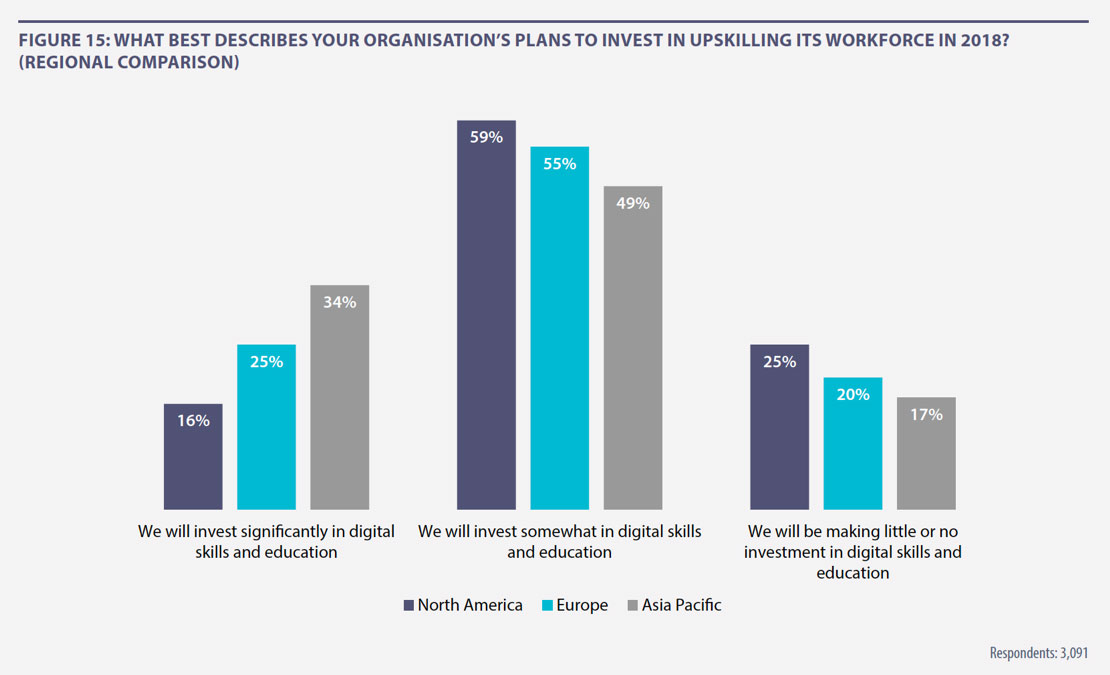

Figure 16 shows where companies are prioritising their efforts in 2018, and therefore where they should be focusing their training activities. It is no surprise to see that social media engagement (26%) figures so prominently, given the extent to which this discipline was deemed to be an exciting opportunity in 2017 (Figure 1). Content marketing (25%) and targeting and personalisation (24%) are also among the top-three priorities for the year.

Further analysis of the data shows that targeting and personalisation is the top priority in North America, with 30% of companies in this region saying this is one of their three main areas of focus. Content marketing (26%) is top of the agenda in Europe, narrowly ahead of targeting and personalisation (25%), while respondents in Asia Pacific are more likely to point to social media engagement (31%) and brand building / viral marketing (25%).